Create new businesses Corporate venture capital (CVC)

Tight-knit support that expands the potential

of the real estate business

Overview of the project

Marking our 100th anniversary, we shifted our corporate venture capital (CVC) activities into high gear. We established the MOL PLUS Daibiru Desk, which we jointly operate with the Mitsui O.S.K. Lines (MOL) Group company CVC MOL PLUS Co., Ltd., and are aiming for “new town planning” by upgrading our real estate business and driving new business creation. We will achieve this through investment in and support for start-ups, with an emphasis on property technology (initiatives to address challenges in the real estate industry and transform traditional business practices via technology), smart city technology, environmental sustainability, and digital transformation (DX).

Details

Transformation for the next 100 years through CVC

The MOL Group is aiming to further stabilize its management by focusing efforts on non-shipping ventures, including real estate, in addition to its core shipping business. As part of this initiative, we will strengthen our CVC business with the Group acting as a unified whole and thereby engage with the challenge of meeting the evolving needs of society while striving to become a capable and resilient corporate Group that will grow globally.

Our CVC activities transcend mere provision of funding, deploying “tight-knit” support to achieve mutual growth and driving increased sophistication in the real estate business and new business creation through collaboration with start-ups.

Striving to build a next-generation real estate model through investment and collaboration

In November 2024, Daibiru invested in MetaProp Ventures IV, a venture capital firm that specializes in the domain of real estate technology. In March 2025, we invested in AirX, which is developing a vertical platform for “flying cars.” AirX is aiming for the social implementation of air mobility, the achievement of which is a potential key to enhancement of the asset value of Daibiru’s buildings.

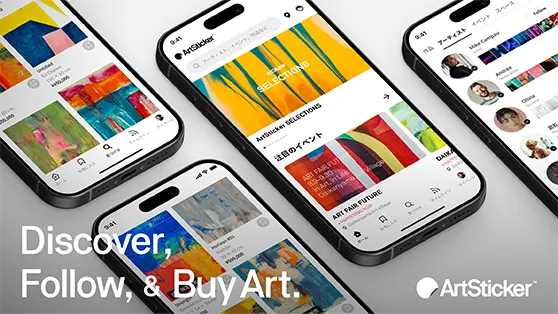

In October 2025, we furthermore completed investments in Asilla Inc., which develops AI security solutions, and The Chain Museum, which is involved in art related business, such as the operation of a specialized art EC platform. Through business partnerships such as these, we will create a next-generation building operations model leveraging AI technologies and incorporate art into urban development and town planning to enhance the asset value of Daibiru’s buildings and the areas in which we operate.

VIEWPOINT

Enthusiastic dialogue opens the way to enhanced corporate value

I am always inspired by dialogue with the enthusiastic operators of start-up businesses. I feel great satisfaction in the process of imagining and implementing the future based on what I have realized through dialogues. I was challenged by the small team size and the need to provide rapid responses, but I used this as fuel for growth. In the future, I want to pioneer more possibilities for town creation.

Corporate Planning Department

S.C. Joined mid-career to current post in fiscal 2021.